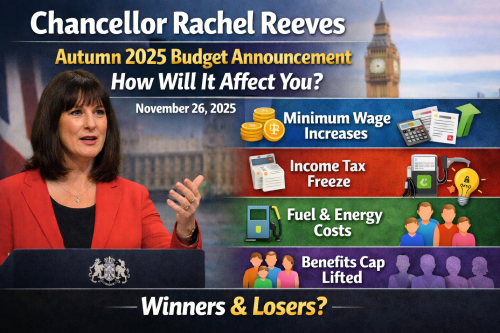

On Wednesday 26th November, 2025, Chancellor Rachel Reeves made her Autumn Budget Statement. Not before the OBR (Office for Budget Responsibility) had accidentally published their assessment of her Budget early.

Whilst the Chancellor – and the Shadow Chancellor – expressed their disappointment at this error, the fact remains that whenever a Budget statement is made, the people of the UK are financially affected. Both positively and negatively.

Chancellor Rachel Reeves, amongst other pledges, stated that previously she had said she would cut the cost of living and she said she meant it.

So let’s take a look at how this most recent Budget statement might affect you and your finances. Will it help to cut your cost of living?

National Minimum Wage & National Living Wage

Are you going to be any better off with increases in the Natiınal Minimum Wage and the National Living Wage? Lots of you who work part time might be on this wage. Here’s what was announced regarding your earnings:

If you are 16 to 17 years old and in work or you are doing an Apprenticeship, your minimum wage will rise from £7.55 to £8 per hour. This is a rise of 6%.

If you are between 18 and 20 years old and you were previously earning £10 per hour, you will now get an increase of 85 pence per hour, taking your hourly rate to £10.85 per hour. This is a rise of 6%. If you are working full time, this is a rise of £1,500 per year.

If you are older and are earning the National Living Wage, this is currently £12.21 per hour. This will increase by 50 pence per hour, taking your hourly wage to £12.71 per hour. This is a 4.1% pay rise and it means you will be earning around £900 more per year if you are working full time. If you are working part time and flexible hours, you will notice this more in your hourly rate of pay.

Chancellor, Rachel Reeves says this increase has been made to help people with the cost of living.

Critics, however, say this move will put pressure on employers in small businesses who have lots of staff on the minimum wage and National Living Wage. Especially in the hospitality sector where there is already lots of pressure on smaller businesses with the rising costs of operating a business.

Income Tax & National Insurance

One area where many of us notice the difference in our pockets when it comes to the Budget statement is what the Chancellor announces with regards to National Insurance contributions and the Income Tax threshold.

If you are working part time or looking for part time work, the Income Tax threshold can be particularly important for you.

A Freeze: From 2028, your Income Tax and National Insurance thresholds will be frozen for a further three years. This is a freeze that was implemented by previous governments and the Labour Government is continuing with the strategy.

Whilst this is going to affect you directly – you could find yourself landing into higher tax brackets as your earnings increase with inflation and pay rises whilst your Income Tax threshold remains the same – Chancellor, Rachel Reeves says this measure will ensure that higher earners contribute the most.

This measure is what is often labelled as a ‘stealth tax’ because it is not as noticeable and not as controversial as an increase in the headline rate of income tax.

The OBR (Office for Budget Responsibility), the freeze in tax thresholds will mean around 780,000 people could be paying Income Tax for the first time whilst 924,000 will be pulled into paying higher rates.

If you are working part time and not earning enough to pay Income Tax currently, this may be something you will need to look into for 2028.

Getting Around

Driving

If you use a vehicle to get around, this can be one of the main things that depletes the bank account.

At least for the next few months – up until September 2026 – the Chancellor has once more concentrated on limiting the impact of the cost of living by keeping the freeze on fuel duty; namely petrol and diesel.

So your commute to and from work and other journeys won’t be costing you any more than they do right now when it comes to fuel.

From September 2026, however, there will be staged increases. Something to bear in mind for next year.

From 2028, if you drive an electric vehicle or plug-in hybrid car, there will be a new tax levied on these. This will be a mileage-based tax. So this could impact your pocket after this date.

The cost of the tax for electric cars will be 3 pence per mile meaning you could be paying around £20 per week or £240 per year. For hybrid cars, the cost will be 1.5 per mile, equating to £10 per week or £120 per year. This will increase in line with inflation each year.

Rail Travel

If you use the train and you are based in England, then the good news is there will be a freeze in train fares. This is the first time there has been a freeze since 1996 and the measure will come in 2026.

Rail fares can take a chunk out of your wages if you use the train to commute so this is good news for those of you who do get to and from work in this way.

Health

If you have prescription medication and you live in the UK, the good news is there will also be a freeze in the charges for your prescription. The current charge is £9.90. As you will know, if you are in Wales, Scotland or Northern Ireland, your prescription is free.

Tobacco & Drink Duty

If you smoke or you enjoy the odd tipple, you probably won’t be surprised to learn that these are going to cost you more.

The cost of tobacco will rise at two percentage points above the retail prices index and alcohol will go up in line with the retail prices index (RPI) – a rise of 3.66%. This also includes drinks sold on draught and it will come into place in February 2026.

With regards to alcohol, if the rise in duty is fully passed on to you, the consumer, this equates to an extra 2 pence on a standard pint (4.5% volume) and and extra 3 pence on a glass of wine at 12% volume.

And if you like to quench your thirst with pre-packaged milkshakes and lattes, these drinks have now been added to those drinks that are affected by the Sugar Tax (the Soft Drinks Industry Levy). Lattes and milkshakes will be taxed from January 2028 and this will raise up to £100 million.

Good News For Your Energy Bills?

When it comes to your energy bills, Chancellor Rachel Reeves made an announcement that means you could see a noticeable reduction in your outgoings.

The home insulation scheme which was introduced by the Conservative Government – ECO Energy Company Obligation Scheme – has been scrapped and this means you could notice your bills reducing by £150.

Whilst this is excellent news for your pocket, depending on your home and your financial situation, you could have been eligible for help to insulate your home under the scheme.

Critics of this particular Budget announcement have pointed out that although bills will noticeably reduce by £150, low income households will no longer be able to benefit from the scheme. This means they might not be able to afford to insulate their homes and bring their bills down in the longer term.

Two-Child Benefit Cap Lifted

Previous summaries that we have written on the most recent Budget Statement have always stated that the two-child benefit cap for Universal Credit and tax credit will remain in place.

This was always heavily criticised because those critics said it was a measure that ensured low income families with more than two children were living in poverty. Those children were not being given the best chance in life and Chancellor, Rachel Reeves, said the cap was being lifted because children should not be penalised for being part of larger families.

If you are one such family then you are finally set to benefit from a lift in the benefit cap so that your third child and subsequent children can also benefit. You will be able to claim this from April 2026.

Those in support of this believe it goes a way to tackling child poverty. 450,000 children are set to benefit from this measure.

As with any Budget Announcement, as well as supporters of a move, there are also critics of the removal of the benefit cap.

Property & Council Tax

From April 2028, there will be a high-value council tax surcharge. This is what you might have seen labelled as a ‘Mansion Tax.’

If you live in a property worth £2 million or more, the surcharge will be £2500 per year. And whilst this shouldn’t affect lots of people who might be reading this article, if you do own a property that is worth £5 million or more, your surcharge will be £7500.

Some people think Chancellor, Rachel Reeves should have set the £2 million threshold lower than this but would affect more working families in London where the property prices are higher than elsewhere around the country.

Changes For Your ISA

If you are someone who has money put away in an ISA then there are some changes for you. ISAs are popular with people because all interest and gains within them are tax free.

Unfortunately, if you are the type of person who has managed to save up to the annual £20,000 threshold, you won’t be able to do this anymore after April 2027.

It’s not all bad news, however, as you will still be able to invest up to £20,000 annually in a Stocks & Shares ISA. And if you are over 65, you are exempt from any of these changes so you can continue to save as before.

The threshold for everybody else will be reduced to £12,000 and if you are looking to become a fırst time buyer in the future, the Government is looking to implement a new, simpler ISA in 2026 to help with this.

The changes to your ISA will come into effect from April 2027 and it is hoped that this will encourage people to invest more in the stocks and shares ISAs.

Are You Happy With The 2025 Autumn Budget Statement?

The Budget affects everyone differently, depending on their personal circumstances and there will be the happy people and the not so happy.

If you are looking for part time work for whatever your personal circumstances are, why not sign up to UK Part Time Jobs or take a look at what’s on offer to see if there is something to suit you.